On August 20, the Riksbank will announce the outcome of its most recent policy meeting. What will it decide to do with interest rates?

My earlier reaction function

In an earlier post, I estimated a simple reaction function for the Riksbank for the years 2021-2024. In that unusual period the focus of monetary policy was solely on bringing down inflation, with less concern attached to the costs to the real economy of the substantial rise in interest rates. Indeed, one way to bring down inflation was to create slack in the economy.

The data chose a specification in which the change in the policy rate was a function of the real policy rate, computed as the difference between the policy rate and CPI inflation. Surprisingly, CPIF (the CPI with a fixed interest rate) inflation and CPIF ex energy inflation were less significant. The implied equilibrium real interest rate, R*, in sample period was estimated to be -1.7%.

Given that the policy rate at the time I write this is 3.75%, that model suggests a cut of -0.25% for inflation rates between 1.2% and 4.1% and a cut of -0.50% for inflation rates below that range.

However, R* may have risen recently. If so, the Riksbank would be less keen to cut interest rates. But with inflation closer to target, the Riksbank may attach greater weight to economic activity and the state of the labour market than it did as it sought to curb inflation. That would make it more keen to cut interest rates.

Overall, the model may thus have become outdated. While it may serve as a starting point for an analysis, it is essential to review macroeconomic conditions in Sweden in greater detail.

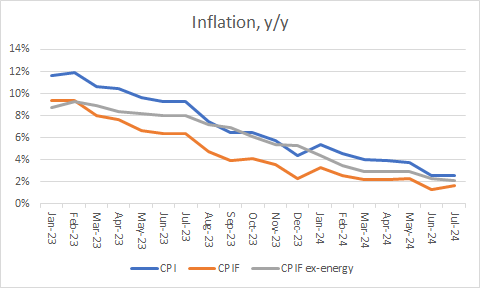

Price pressures

It is unrealistic to expect that a central bank can stabilise inflation exactly at the target — being 0.2% or 0.3% away is as good as it gets. In my view, the Riksbank has essentially achieved its 2% target for CPIF inflation. While it undershot the target by falling to 1.3% in June, it rose to 1.7% in July. CPI inflation remained unchanged at 2.6% in July while CPIF ex energy inflation fell from 2.3% in June to 2.2% in July.

Source: Statistics Sweden.

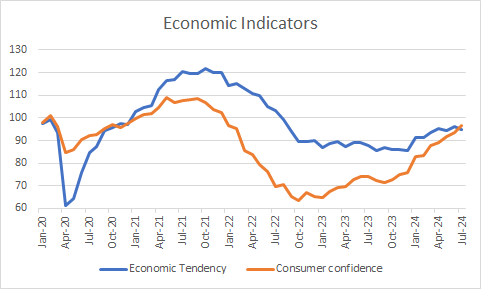

Real economic activity

With Sweden having returned to price stability, the Riksbank’s concerns will have shifted from inflation to worries about economic activity. After declining in 2022 as the Riksbank and other central banks started to tighten monetary policy sharply, the Economic tendency and Consumer confidence indicators have been rising towards their means (of 100) over the last year or so.

Source: KI

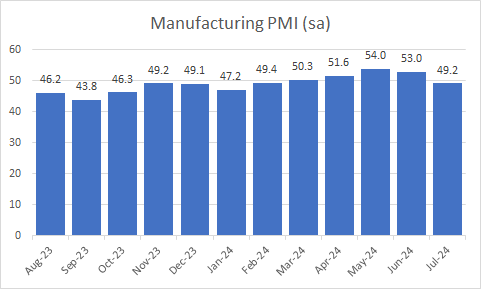

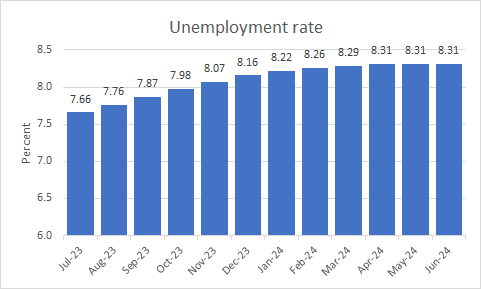

However, recently the Manufacturing PMI has started to decline, and the unemployment rate has been rising since late 2022.

Source: SILF SwedBank

Source: Statistics Sweden.

These developments are related to the external environment turning increasingly adverse for Sweden’s export-dependent economy. Although the US economy is growing, concerns about a recession are rising. The euro area appears to be slowing and the German economy, Sweden’s largest export market, is struggling.

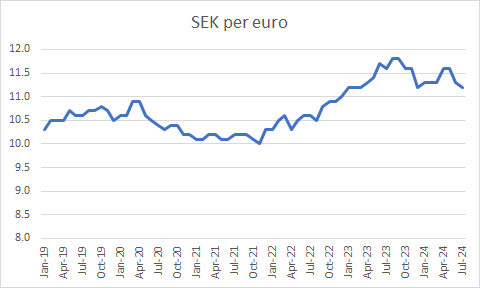

Exchange rate

Source: KI

Both the Fed and the ECB are expected to cut interest rates in the second half of this year, although to varying extents. That gives the Riksbank room to cut interest rates, without necessarily triggering further weakness of the krona (although the krona’s exchange rate has in recent decades not been a main driver of Swedish monetary policy).

Conclusions

All-in-all, the dramatic increase in interest rates over recent years has had the expected impact on the real economy. That was the price of stemming the inflationary surge. With inflation around the target and economic activity softening, the Riksbank has plenty of room to cut rates on 20 August.