Having returned from vacation I decided to look through the Swiss CPI data for September together with the Monetary Policy Assessment released by the SNB on 26 September.

Before the SNB decision, my model attached the highest probability to the SNB cutting interest rates by 0.25%, but also indicated a substantial probability to it cutting rates by 0.50%. That seems to have been broadly right. I was struck by the sentence in SNB’s press release that “Further cuts in the SNB policy rate may become necessary in the coming quarters to ensure price stability over the medium term.” It appears as if the SNB already at the meeting felt that it had not done enough.

The driver of policy is the outlook for inflation, which is running low. The SNB stated that “The new forecast is within the range of price stability over the entire forecast horizon. It puts average annual inflation at 1.2% for 2024, 0.6% for 2025 and 0.7% for 2026.”

It is of course true that these inflation rates are well within the SNB definition of price stability. However, they are not certain. With a forecasted inflation rate of 0.6%, a small shock could push inflation below zero and Switzerland back into deflation. Given these forecasts, one wonders whether it would not have made sense for the SNB to cut by 0.50% in September.

It didn’t. But risks to inflation are in my view to the downside, and seeing these forecasts one can’t disagree that “further cuts may be necessary.”

Inflation: outcomes and forecasts

So, let us turn to inflation. Since the SNB plots quarterly averages of inflation in its monetary policy assessment, and we have data from three completed quarters of 2024, I will use quarterly averages too.

Source: BfS

The graph shows headline CPI inflation together with inflation “without petroleum products” (which I will call “ex petroleum”) together with the forecasts the SNB released in June and in September. Plainly, the fall in the prices of petroleum products in Q3 has played an important role in the decline of inflation to low levels in Switzerland.

Headline inflation has fallen below inflation ex-petroleum, largely due to petroleum prices falling by 4.2% in Q3 (the strong exchange rate has mattered too). While they have a weight in the CPI index of merely 2.8%, the effect is much larger once the indirect effects are considered (some back-of-the-envelope econometrics suggests that the effective weight is 4.6%). The graph also shows how the SNB has lowered its inflation forecasts.

An inflation forecast

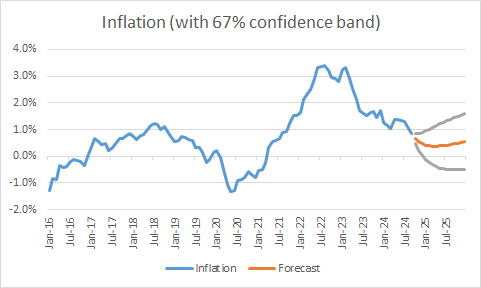

Given the role played by petroleum prices – which are notoriously difficult to forecast – for the current dip in inflation, I estimated a simple VAR(2) model of annual inflation and inflation ex-petroleum, using monthly data from January 2016 to September 2024, and then computed dynamic forecasts of inflation until the end of 2025.

Before looking at the forecasts, I highlight that this model uses only the past dynamics of the two variables to forecast future inflation. It thus disregards the fact that petroleum prices have risen in recent weeks (and may rise further) and the electricity price cuts announced for next January. Thus, these forecasts can at best serve as a broad benchmark.

Source: my estimates as described in the text

Interestingly, these forecasts have the same shape as the SNB’s shown in the previous graph: they both predict inflation to fall in the next two quarters, then bottom out in 2025 but remain below 1%. While the SNB forecasts 1.0% inflation in 2024 Q4, 0.6% in 2025 Q1 and 0.5% in 2025 Q2, my naïve forecasts point to inflation of 0.6% in Q4 and 0.4% in 2025 Q1 and Q2. That is not far above zero. Indeed, the lower limit of the 67% confidence band falls to -0.5% in 2025.

Summing up

Inflation has been much weaker than the SNB forecasted, and it has revised down its forecasts until 2027. While it is in the price stability range, it is close to zero. Little is needed to push it below zero.

Are the risks to the outlook for inflation equally balanced? I think not. We are now seeing increasingly how the dramatic monetary policy tightening central banks engineered in 2022 is putting pressure on inflation and economic activity globally. Over time, as financial contracts are renegotiated, the impact of policy strengthens. While central banks are cutting rates, I worry that they do so too slowly. If so, Switzerland could soon be back in deflation.

I expect the SNB to cut rates, perhaps aggressively, on December 11 and into the new year. With bad luck, we could be back to zero interest rates by next summer.

Thanks Stefan for the detailed analysis. I assume that the SNB can tolerate inflation close to zero if the economic activity and the labour market are solid. If inflation was negative and the policy rate at the ZLB, then the SNB will likely resume asset purchases. It remains to be seen whether central banks are still willing to set rates into negative territory.

We will see in December by how much will the SNB cut its policy rate.