Quick Comment: Final June CPI Inflation for Sweden

Punchline: June’s inflation numbers in Sweden came in higher than hoped for, raising questions about whether the Riksbank will keep cutting rates. But after adjusting for seasonal patterns, the picture looks less alarming — apart from core inflation, which remains stubbornly high.

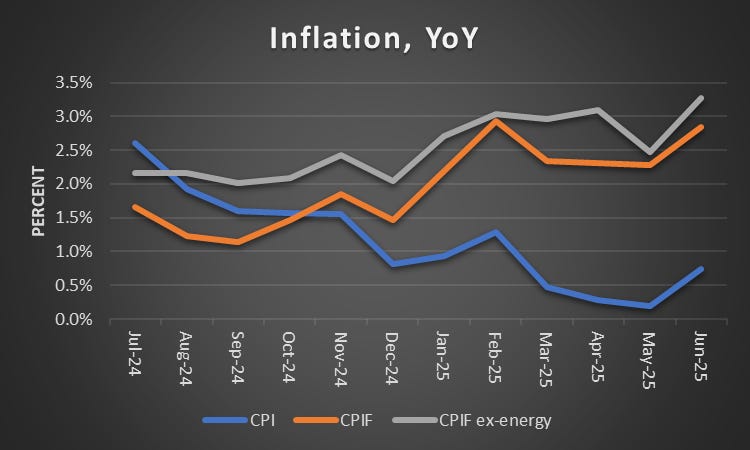

Last week, Sweden’s flash estimate for June CPI inflation was published, and the data were discouraging. While annual CPI inflation was 0.8%, CPIF (inflation at a fixed interest rate, which the Riksbank has a 2% target) came in at 2.9%, and CPIF excluding energy (which I view as core inflation) was 3.3%.

The final figures, published earlier this week, were slightly better: CPI and CPIF were revised down by 0.1 percentage points to 0.7% and 2.8%, while CPIF-XE stayed at 3.3%.

The graph below shows that since September 2024, CPIF and CPIF-XE have been edging up, even as headline CPI inflation has fallen.

Source: SCB

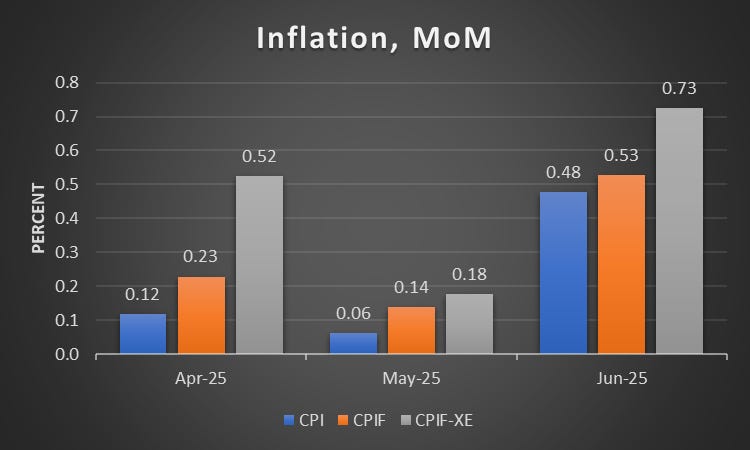

The next graph shows that monthly inflation for June was strong — 0.5% for CPI and CPIF, 0.7% for CPIF-XE. Taken together, these two graphs do not suggest the Riksbank will rush to cut rates.

Source: SCB

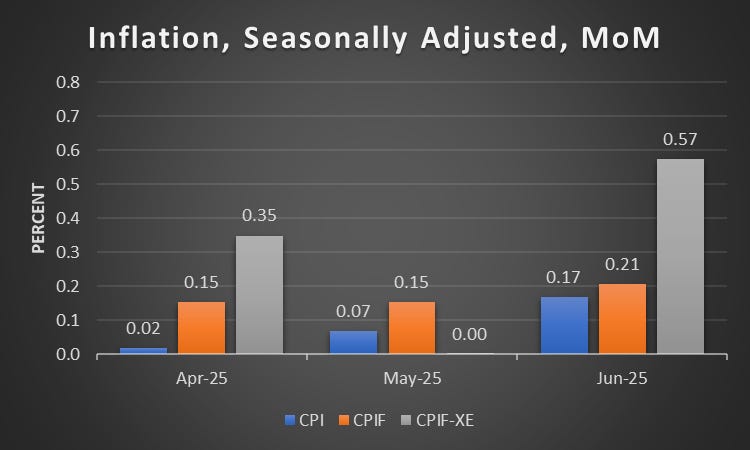

However, the CPI figures are not seasonally adjusted. Looking at data since 2010, CPI and CPIF inflation in June have averaged 0.2% higher than in May, while CPIF-XE is usually 0.1% lower. To judge the monthly inflation rates, it is therefore important to use seasonally adjusted data.

Unfortunately, the SCB does not publish seasonally adjusted data, so I have done the adjustment myself. I cannot do as good a job as the SCB, but my adjustment gives a rough sense of what the seasonally adjusted data might look like.

Source: My computations on SCB data

The seasonally adjusted series shows less reason for alarm. Calculating the annualised inflation rate over the last three months, seasonally adjusted CPI has averaged 1.0%, CPIF 2.0%, and CPIF-XE 3.7%. Thus, if inflation stays at these levels over the coming months, CPIF will be at target.

Overall, while inflation is a little high, over the last quarter the seasonally adjusted data suggest it is broadly in line with the Riksbank’s target, apart from core inflation, which remains elevated.

I do like how you’ve balanced caution with context, steering away from doom-mongering. What do you think needs to happen next before the Riksbank feels confident enough to ease rates?