Quick comment: Swedish Inflation Surprises on the Upside

Punchline: the flash CPI data for June were unexpectedly strong. While that lowers the likelihood of a cut in August, the full CPI data release on July 14 will be more informative and important.

A sharp upside surprise in Swedish inflation in June has cast doubt on expectations of near-term policy easing by the Riksbank.

According to Statistics Sweden’s flash estimate, annual headline CPI rose to 0.8% year-on-year in June, up from 0.2% in May. CPIF inflation, which the Riksbank targets, climbed to 2.9% from 2.3%. CPIF-XE, which excludes energy prices and is often viewed as the Riksbank’s preferred indicator of core inflation, jumped to 3.3% from 2.5%.

Source: Statistics Sweden (SCB)

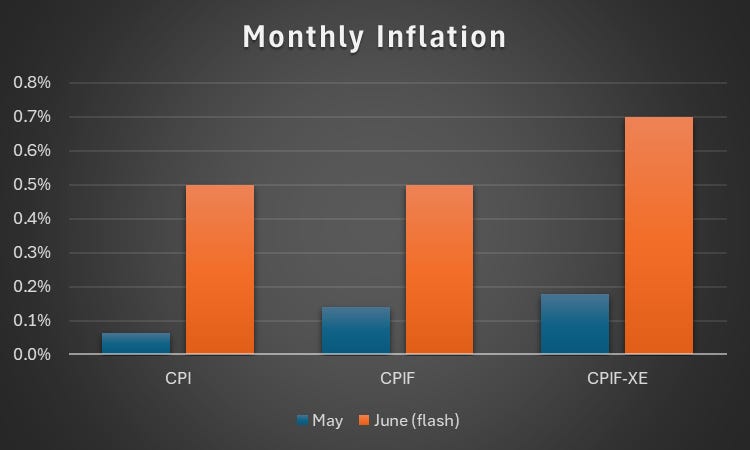

Inflation also rose strongly on the month. CPI and CPIF both increased by 0.5%, while CPIF-XE rose by 0.7%.

Source: Statistics Sweden (SCB)

The upside surprise complicates the near-term policy outlook. Two-year government bond yields, which are sensitive to policy expectations, rose from 1.70% at the Friday close to 1.79% by the close of business on Monday. This indicates that market participants scaled back their expectations of a near-term rate cut.

That said, CPI data can be volatile and influenced by temporary or technical factors. The full June release, due on 14 July, is likely to be more informative. But for now, with inflation running above target, the case for near-term easing appears to have weakened. Markets and policymakers alike will be watching the full data release closely.