On Tuesday I was visiting a central bank and was therefore not able to comment immediately on the Swiss CPI data. But here come some thoughts.

To start with the conclusion: While annual inflation is 1.1%, I estimate it to be -0.2% when measured over 3 months. This reflects the recent appreciation of the franc. I expect the SNB to respond by cutting interest rates when it meets later this month.

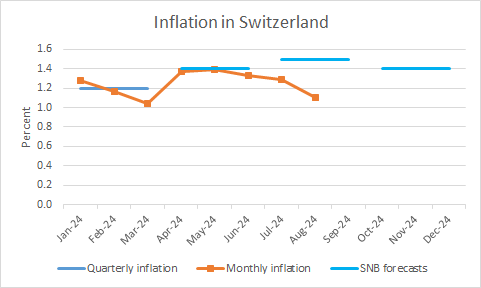

SNB’s June forecast

At the June policy meeting, the SNB forecast inflation of 1.5% in Q3. With July inflation at 1.3% and August inflation at 1.1%, annual inflation is plainly quite a bit weaker than the SNB expected.

Source: SNB and BFS data

Looking at the details

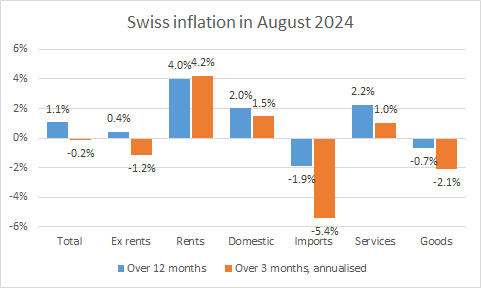

It pays to look at the details. Since inflation over 12 months is best thought of as the average monthly inflation rate over the last year, it is a lagging variable. To get a sense of current price pressures, it is often helpful to look at annualised inflation over a much shorter time span, such as 3 months.

That is difficult to do in Switzerland since the official CPI data are not seasonally adjusted. I therefore seasonally adjusted the data myself and compute annualised inflation over 3 months.

HEALTH WARNING: these data are not official, and they should therefore be taken with a grain of salt.

Source: my calculations on BFS data

The first thing to note is that while annual inflation was 1.1% in August and close to the mid-point of the SNB’s 0-2% inflation target definition of price stability, over three months it was ‑0.2% (!).

Since the SNB’s earlier interest rate increases have pushed up rents, commentators often look at inflation without rents. Annual inflation ex rents was 0.4% in August; over 3 months it was ‑1.2%. Rents are still rising rapidly.

To understand the behaviour of inflation better, it is useful to distinguish between domestic and imported prices. Domestic prices rose by 2.0% over 12 months and 1.5% over 3 months, imports fell by -1.9% over 12 months and by -5.4% over 3 months.

Similarly, while services inflation was 2.2% over 12 months and 1.0% over 3 months, goods inflation was -0.7% over 12 months and -2.1% over 3 months.

Conclusions

The weak inflation, in particular when measured over 3 months, is due to the recent appreciation of the franc that has lowered imported inflation and goods prices. With financial markets expecting an imminent relaxation of monetary policy by the Fed and the ECB, both of which has more room than the SNB to cut interest rates, that is not surprising. I expect the SNB to respond by cutting interest rates at its next policy meeting later this month.

Very interesting analysis! I am wondering if they would consider 50bps cut or engage in further FX intervention.

Hi Stefan,

Relevant analysis of Swiss inflation which provides evidence that a rate cut at the upcoming SNB meeting is highly likely. It seems that the main component driving this inflation are rents! Given the negative impact of imported inflation, I wonder whether the SNB will resume foreign asset purchases.