Quick comment: Swiss inflation in August

Seasonal adjustment reveals summer uptick

Punchline: Seasonally adjusted data show that inflation has strengthened over the summer, with annualised three-month inflation now running at about 1%. This contrasts with the headline year-on-year rate of 0.2%, which is held down by downward price pressures during the spring. The SNB will be pleased by these developments, which suggest that underlying inflation is firmer than the annual figures imply.

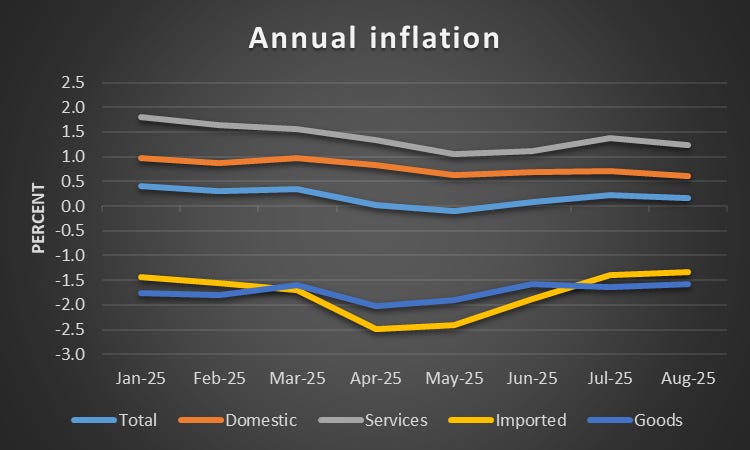

Swiss CPI data released last Thursday likely reassured the SNB. Annual headline inflation was 0.1% in June and 0.2% in both July and August, suggesting that earlier fears of deflation were overstated.

Domestic inflation edged down slightly to 0.6% in August from 0.7% in July. Services inflation declined to 1.2% from 1.4%. While this might suggest softer underlying pressures, import price inflation became slightly less negative, rising to -1.3% from -1.4%, and goods price inflation remained unchanged at -1.6%.

Source: FSO

Seasonal adjustment matters

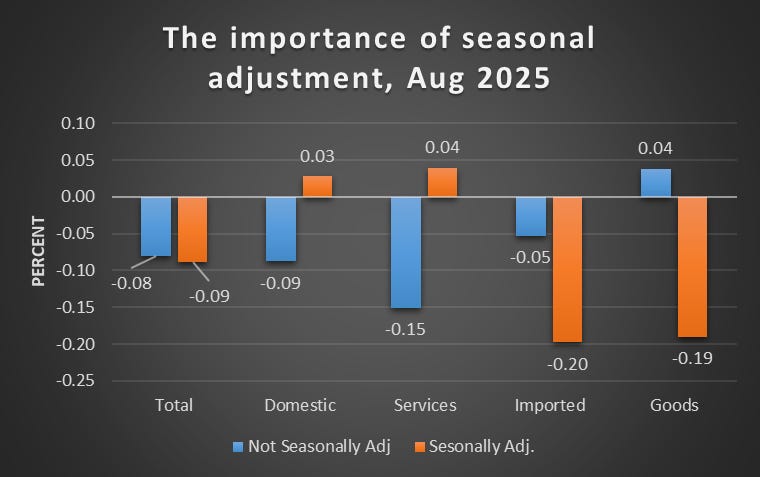

Swiss CPI data are published in seasonally unadjusted form, making short-term movements difficult to interpret. To address this, I seasonally adjusted the data — though, of course, the Federal Statistical Office would do a better job. This makes it possible to compute inflation trends over shorter periods than a year and to understand what is driving price changes now.

To see the importance of this, in August the unadjusted data showed a 0.1% monthly decline in prices, driven by weaker domestic and services prices. However, the adjusted data tell a different story: the fall was mainly due to declining prices of imports and goods. Without seasonal adjustment, it is easy to misread what is driving short-term changes.

Source: my calculations on data from FSO

Why shorter horizons matter

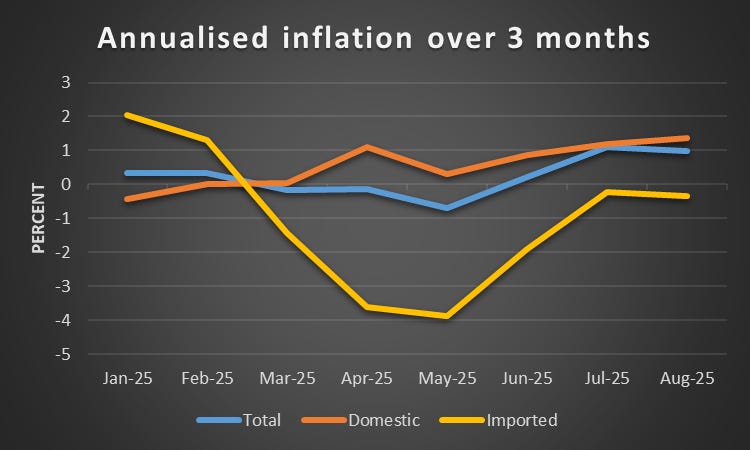

Year-on-year inflation is an average of price changes over the past 12 months. This means it can remain low today because inflation was weak many months ago, even if more recent price trends are stronger. For policymakers, the latest few months of data are far more relevant for assessing current inflation pressures.

The first chart below shows total inflation alongside domestic and imported inflation, calculated over a three-month horizon and annualised. Inflation has hovered around 1% over the last two months. The dip to 0.7% in May reflected import prices falling at an annual rate of -1.9%, but that decline has now moderated to -0.3% in August.

Source: my calculations on data from FSO

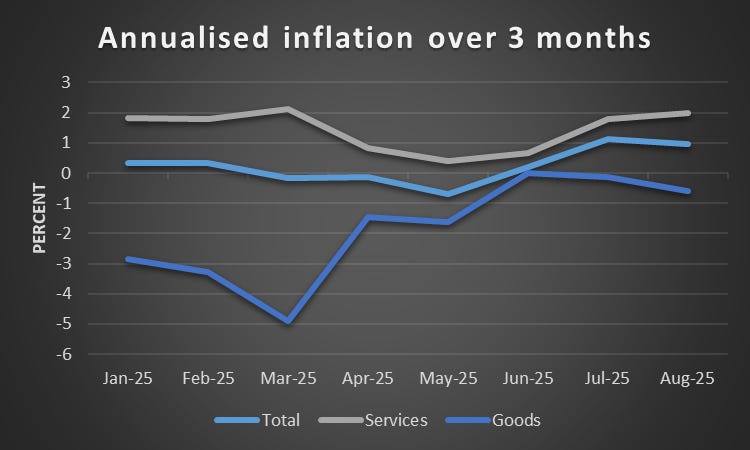

The second chart shows headline inflation together with the goods and services components. It reveals that the spring slowdown of total inflation was driven by falling goods prices. Goods price inflation also declined sharply in July and August, while services inflation, which has a much larger weight in the CPI, has risen steadily since May and is now running at an annual rate of 2%.

Source: my calculations on data from FSO

Implications for the SNB

This report is the last major data release before the SNB’s policy meeting on 25 September. Based on what we have seen of the Schlegel board so far, the SNB is unlikely to cut rates unless inflation drops well below zero or the economy moves into a marked recession. At present, there is little evidence of either. Inflation has been low over the past year but has been running at 1% in recent months. Unless the outlook for the Swiss economy worsens sharply, interest rates are likely to remain at zero into 2026.