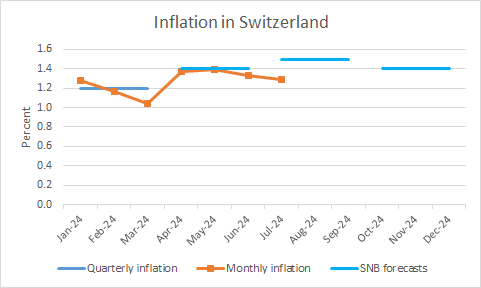

When the SNB set monetary policy on 19 June (as always, the decision is made the day before the announcement), it did not know what inflation in June would be. However, in the press release announcing the decision, it projected an average inflation rate for Q2 of 1.4%. It also forecast an average inflation rate of 1.5% for Q3 and 1.4% for Q4.

Recent inflation data

Since then, data on inflation in June and July have been published. They indicate that inflation was 1.3% in both months. Since the SNB’s focus is squarely on achieving and maintaining price stability, which it defines as inflation in the range of 0-2%, one wonders what role these data releases may play for the SNB’s next policy decision, which will be announced on 26 September.

The chart below shows the quarterly average of inflation, as announced by the SNB, its forecasts for inflation in 2024 Q3 and Q4, and the monthly inflation rate until July.

Sources: SNB and Bundesamt für Statistik.

Inflation averaged 1.36% in Q2, that is, almost 1.3% rounded. While the SNB’s projection of a quarterly average inflation of 1.4% thus was accurate, one wonders if June inflation of 1.3% was a bit less than it had projected.

For Q3 the SNB projects an average inflation rate of 1.5%. Given that July inflation was 1.3%, the average inflation rate in August and September must be 1.6% for its projection for the quarterly average to be achieved. That is of course possible, but again one wonders if inflation is not coming in a little weaker than the SNB had anticipated.

Indeed, if I forecast inflation from June onwards with the forecasting model I used for my earlier post, the forecast is for 1.4% inflation in June and July (and 1.5% inflation in August). Thus, inflation is coming in a little below that forecast.

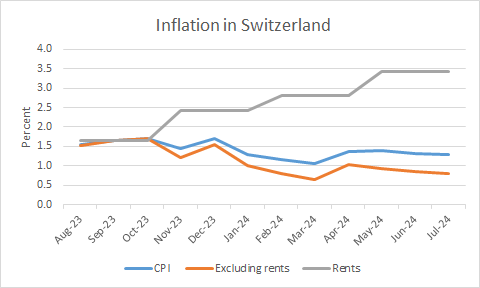

Interest rate changes, rents and inflation

One important driver of inflation in the recent past has been the SNB itself, as the SNB’s interest rate increases have boosted the rental component of the CPI (which has a weight of 18.4%). This is because in Switzerland rent increases are linked to changes in the interest rate. To explore the importance of this effect, the chart below shows overall inflation, inflation excluding the rental component and the rate of change of the rental component.

Source: Bundesamt für Statistik.

The punchline is that while inflation was 1.3% in July, the rate of increase of rents was 3.4% and inflation excluding rents was 0.8%. Thus, the SNB’s interest rate increases added about 0.5% to inflation by affecting rents.

In situations in which the SNB changes interest rates substantially, inflation excluding rents is arguably a better indicator of underlying price pressures than the headline inflation rate. Indeed, some central banks, including the Riksbank, disregard the impact of monetary policy on inflation via rents since it is perverse, that is, interest rate increases boost inflation through this mechanism. In fact, SNB rate cuts will gradually reduce the rental component, in the same way as rate increases boosted it.

Conclusion

Overall, the SNB is likely to have viewed the June and July inflation releases as indicating that inflation pressures in Switzerland are weak. Of course, plenty of data – including inflation in August – will be published between now and the SNB’s decision on 26 September and much can change. But for the moment it seems more likely than not that it will decide to cut interest rates by 0.25% a third time in a row.

Interesting and very detailed analysis about the realised versus expected level of calculated inflation. In order to avoid to be "penny wise and pound-foolish", please keep in mind -while you focus on a 0.1% move- that the mandatory medical insurance costs have risen almost 10% on annual basis, but this is not included in the basket, ditto for transportation costs ("halbtax abo"). Said that, an interest cut by 25bps in September is likely even if FX intervention is a much more powerful tool to control inflation.

Interesting analysis! cannot agree more indeed especially on the role of the rent component in contributing to persistent service inflation. I would also add the challenge coming from relatively strong CHF.